Blockchain Interoperability: Connecting the Dots Across Multiple Networks

Table of Contents

The development of blockchain interoperability solutions has become crucial to address the limitations of individual blockchains and unlocking the true potential of decentralized systems. By enabling seamless data transfer and cross-chain transactions, blockchain interoperability facilitates a more interconnected and versatile blockchain landscape.

Understanding the Need for Interoperability in Blockchain Networks

- Silos of Data and Value: Blockchain networks, like Bitcoin and Ethereum, are often referred to as “silos” because they operate independently with little to no interaction with each other. As a result, valuable data and digital assets get locked within their respective blockchains, limiting their usefulness and potential applications. Interoperability breaks down these silos, allowing data and value to flow freely between different networks.

- Scalability and Performance: Blockchain networks face scalability issues when they experience a surge in usage and transaction volume. By enabling cross-chain transactions, interoperability can offload some of the traffic from congested networks to others that have spare capacity. This can significantly improve overall system performance and enhance transaction speeds.

- Enhancing Functionality: Different blockchain networks have unique features and capabilities. For instance, some blockchains are more energy-efficient, while others prioritize privacy or smart contract functionality. Through interoperability, developers can combine the strengths of multiple networks to create sophisticated applications with enhanced functionalities.

- Cost Efficiency: Interoperability can potentially reduce transaction fees and operational costs by leveraging the strengths of various blockchains. For example, if a transaction is less time-sensitive, it can be routed through a blockchain with lower fees, optimizing cost-effectiveness.

- Promoting Innovation: By fostering collaboration between different blockchain communities, interoperability encourages innovation and cross-pollination of ideas. Developers from various projects can come together to solve common challenges and push the boundaries of what’s possible in the blockchain space.

- Cross-Chain Asset Transfers: Interoperability is particularly crucial for decentralized finance (DeFi) applications, where the seamless transfer of assets between different blockchains is essential. With interoperability, users can move cryptocurrencies and tokens between different DeFi platforms, increasing liquidity and accessibility.

- Interconnected Internet of Things (IoT) Devices: As the IoT ecosystem grows, devices need a secure and efficient way to communicate and transact with each other. Blockchain interoperability can play a pivotal role in enabling IoT devices to engage in trustless and secure interactions across various networks.

- Adoption and Mainstream Acceptance: For blockchain technology to achieve widespread adoption, it must overcome the fragmentation caused by isolated networks. Interoperability can unite these networks and create a cohesive ecosystem that is more appealing to businesses and users alike.

Challenges in Achieving Blockchain Interoperability

- Diverse Architectures and Protocols: The first major challenge in achieving blockchain interoperability arises from the diverse range of blockchain architectures, consensus mechanisms, and protocols in use today. Each blockchain network is designed with unique features that cater to specific use cases. Bridging these networks requires developing solutions that can efficiently communicate and translate data between disparate systems.

- Security and Trust: Interoperability introduces potential security risks, as the seamless exchange of data between blockchains can expose them to vulnerabilities. Ensuring trust and maintaining the integrity of transactions across different networks is a complex task that demands robust cryptographic solutions and thorough testing.

- Consensus Mechanisms: Different blockchains employ distinct consensus mechanisms, such as Proof of Work (PoW), Proof of Stake (PoS), or Delegated Proof of Stake (DPoS). These mechanisms govern how transactions are validated and added to the blockchain. Interoperability solutions must find a way to reconcile the differences in consensus algorithms to achieve a cohesive and reliable network.

- Interoperability Standards: The lack of universally accepted interoperability standards poses a significant challenge. The absence of a standardized framework can lead to fragmentation and hinder seamless communication between various blockchains. Developing common protocols and standards is crucial to facilitating smooth data transfers and fostering collaboration.

- Performance and Latency: While achieving interoperability, it is essential to maintain optimal performance and low latency. Slow transaction times and high fees can deter users from engaging with interconnected blockchains. Solutions that enable near-instantaneous and cost-effective transfers between networks are crucial for the success of interoperability.

Scalability and Throughput Issues Across Multiple Blockchains

- Network Congestion: As the number of blockchain networks and users increases, scalability becomes a pressing concern. Increased demand for processing transactions can lead to network congestion, resulting in slower transaction times and higher fees. Interoperability solutions must consider these challenges and design mechanisms to handle increased loads efficiently.

- Cross-chain Communication Overhead: Enabling communication between different blockchains introduces communication overhead, which can impact scalability and throughput. This overhead includes tasks like cross-validation of transactions and consensus mechanisms between interconnected networks. Efficient methods of communication are necessary to minimize latency and maximize throughput.

- Data Synchronization: When multiple blockchains are interconnected, ensuring accurate data synchronization becomes vital. Divergent data across different chains can lead to inconsistencies and compromise the integrity of transactions. Maintaining real-time data synchronization is a complex task that requires careful design and implementation.

- Economic Incentives: In a multi-blockchain environment, ensuring economic incentives to participate in the interoperability process is essential. Nodes that facilitate cross-chain transactions must be incentivized appropriately to foster a healthy and active network. Designing incentive mechanisms that reward participants for their contributions is critical to achieving long-term sustainability.

- Interoperability Complexity: The process of connecting multiple blockchains inherently adds complexity to the overall system. The interconnected nature of networks introduces potential points of failure and requires sophisticated solutions to manage potential risks effectively.

Also read: Exploring the Potential of Aether: Decentralized Finance and Beyond

Solutions and Technologies for Blockchain Interoperability

- Sidechains and Pegged Assets:

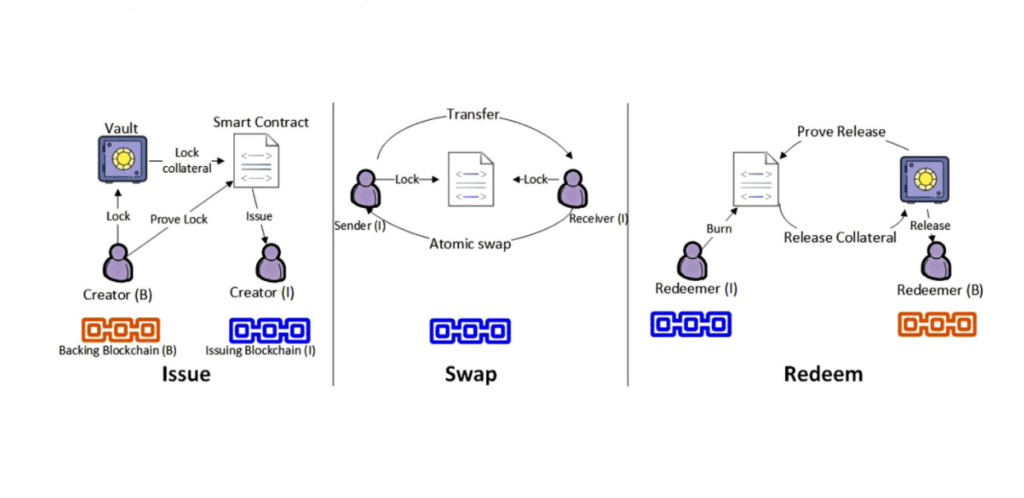

Sidechains are separate blockchains that can interact with the main blockchain (also known as the parent chain) while maintaining a two-way peg. This mechanism ensures that assets can be securely transferred from the main chain to the sidechain and back. Sidechains enable the execution of specific smart contracts and applications, catering to diverse use cases, without burdening the main blockchain. Pegged assets represent a similar concept, where tokens are “pegged” to their corresponding value on another blockchain, allowing cross-chain value transfers.

- Atomic Swaps:

Atomic swaps are trustless peer-to-peer exchanges of cryptocurrencies between different blockchains. This technology enables users to swap assets directly without the need for an intermediary or centralized exchange. Atomic swaps ensure security and reduce counterparty risks, as the swap either occurs entirely or not at all. This solution promotes decentralization and privacy while facilitating seamless cross-chain asset trading.

- Bridge Protocols:

Bridge protocols act as connectors between different blockchain networks, facilitating data and asset transfers. These protocols often rely on a network of validators or intermediaries to confirm transactions on both blockchains, ensuring consistency and security. Bridge protocols play a crucial role in enhancing blockchain interoperability, enabling the exchange of information and value between disparate networks.

- Interoperability Standards:

Establishing interoperability standards is essential to ensure consistent communication between blockchains. Industry consortia, organizations, and blockchain communities collaborate to develop common standards that streamline data formats, communication protocols, and cryptographic techniques. Standards enhance compatibility, encourage adoption, and simplify the process of creating cross-chain applications.

Cross-Chain Communication Protocols: Bridging Different Blockchains

- Polkadot:

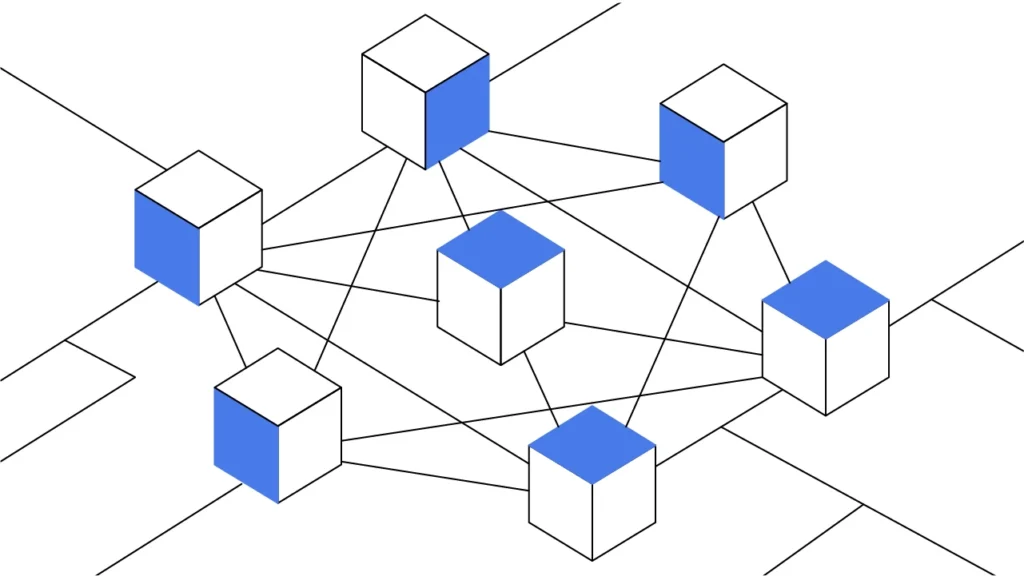

Polkadot is a prominent blockchain project that aims to facilitate interoperability between multiple blockchains through its heterogeneous multi-chain framework. It enables specialized blockchains, known as para chains, to connect to the Polkadot relay chain, creating a unified network. Polkadot’s shared security model and cross-chain message-passing mechanism allow data and assets to move seamlessly between connected blockchains.

- Cosmos:

Cosmos is another ecosystem that emphasizes blockchain interoperability. It employs the Inter-Blockchain Communication (IBC) protocol, enabling communication between independent blockchains within the Cosmos network. IBC functions as a standard for blockchain interoperability, allowing assets and data to be transferred securely and efficiently between connected chains.

- Wanchain:

Wanchain focuses on bridging various blockchain networks by providing cross-chain communication solutions. It leverages secure multi-party computing and threshold key sharing to enable decentralized and trustless cross-chain transactions. Wanchain’s bridge architecture supports interoperability with major blockchains like Bitcoin and Ethereum, expanding the scope of cross-chain functionalities.

- Ren Protocol:

Ren Protocol is a decentralized liquidity protocol that allows for interoperability between blockchains. It facilitates the creation of wrapped tokens representing assets from different chains. For example, Bitcoin can be wrapped into an ERC-20 token, enabling it to be used on the Ethereum network. Ren Protocol enables cross-chain liquidity and opens up new possibilities for decentralized finance (DeFi) applications.

Use Cases and Benefits of Blockchain Interoperability

Blockchain technology has revolutionized various industries by providing secure, decentralized, and transparent systems. However, as the number of blockchain networks continues to grow, a significant challenge arises – a lack of communication and interoperability between these networks. Blockchain interoperability refers to the ability of different blockchain platforms to interact, share data, and execute transactions across multiple networks. By addressing this challenge, blockchain interoperability opens the door to a multitude of use cases and benefits.

- Enhanced Cross-Chain Asset Transfer: One of the most prominent use cases of blockchain interoperability is enabling seamless cross-chain asset transfer. Currently, each blockchain network operates in isolation, restricting the movement of assets from one chain to another. Interoperability solutions break down these barriers and allow users to transfer assets between disparate blockchains efficiently and securely. This capability can significantly enhance liquidity across the entire blockchain ecosystem and unlock new opportunities for asset management.

- Decentralized Finance (DeFi) Expansion: Decentralized finance has witnessed tremendous growth, offering various financial services on blockchain networks. However, the lack of interoperability between different DeFi protocols hinders their full potential. By enabling seamless communication and interaction between DeFi platforms, users can access a broader range of financial products and services, boosting the overall DeFi ecosystem’s liquidity and efficiency.

- Cross-Chain Smart Contracts: Smart contracts are self-executing contracts with predefined rules and conditions. However, they are typically confined to the blockchain on which they are deployed. With blockchain interoperability, smart contracts can span multiple networks, unlocking new possibilities for complex, cross-chain applications. For instance, an application could involve interactions between Ethereum, Binance Smart Chain, and Polkadot, all within a single smart contract.

- Supply Chain Transparency: Supply chain management can greatly benefit from blockchain interoperability. Enterprises often use different blockchain networks for different aspects of their supply chain, such as tracking raw materials, logistics, and product authenticity. By establishing interoperability between these networks, companies can create end-to-end transparency, allowing real-time tracking of goods across multiple stages and networks.

- Data Sharing and Security: Blockchain interoperability enables the secure and transparent sharing of data between different entities. This feature is especially valuable in industries like healthcare and IoT, where sensitive information must be exchanged securely across various platforms. Interoperability ensures that data integrity and confidentiality are maintained throughout the transfer process.

Enabling Seamless Asset Transfer Between Different Blockchains

One of the most critical aspects of blockchain interoperability is its ability to facilitate seamless asset transfer between different blockchains. Traditional blockchain networks, such as Bitcoin and Ethereum, have their native assets (BTC and ETH, respectively). While they serve their specific ecosystems, they lack direct compatibility, making cross-chain asset transfer a significant challenge. However, with interoperability solutions, this hurdle can be overcome, and users can transfer assets seamlessly across disparate blockchains.

- Bridging Mechanisms: Interoperability is achieved through various bridging mechanisms, such as cross-chain bridges, sidechains, and pegged assets. Cross-chain bridges act as connectors between two blockchain networks, facilitating the transfer of assets. Sidechains are separate blockchains linked to the main blockchain, allowing assets to move between them. Pegged assets, on the other hand, are tokens on one blockchain that represent the value of an asset on another blockchain. These mechanisms ensure that assets can be moved from one network to another while preserving their value and security.

- Improved Liquidity: Interoperability significantly improves liquidity in the blockchain ecosystem. Previously, if a user wanted to access a DeFi protocol on a specific blockchain but held assets on another network, they would face the challenge of transferring assets and incurring associated fees and wait times. With seamless asset transfer, users can instantly access DeFi services on various blockchains, increasing overall liquidity and user engagement in the ecosystem.

- Cross-Chain Asset Swapping: Blockchain interoperability enables cross-chain asset swapping, allowing users to exchange one asset for another directly across different networks. This capability is particularly useful for traders and investors looking to diversify their holdings or take advantage of opportunities on other blockchains without having to convert assets back to a common base currency first.

- Enhanced Flexibility: Interoperability grants users the flexibility to utilize assets and applications across multiple blockchains. This flexibility reduces dependency on a single blockchain and mitigates risks associated with network congestion, high fees, or potential protocol changes. Users can adapt their strategies and utilize the most suitable blockchain for their needs, optimizing their overall blockchain experience.

- Facilitating Cross-Network Collaboration: Interoperability fosters collaboration between different blockchain networks, promoting knowledge sharing and innovation. Projects on separate blockchains can integrate their services and resources, leading to the creation of more robust and sophisticated decentralized applications that leverage the strengths of multiple networks.

Also read: Blockchain Security: Safeguarding Digital Assets in a Decentralized World

The Future of Blockchain Interoperability

Blockchain technology has revolutionized the way we perceive data security, transparency, and decentralized systems. Over the years, various blockchain networks have emerged, each with its unique strengths and applications. However, these networks often operate in isolation, leading to fragmentation and inefficiency within the decentralized landscape. To overcome these challenges, the concept of blockchain interoperability has emerged as a vital bridge to connect the dots across multiple networks.

What is Blockchain Interoperability?

Blockchain interoperability refers to the seamless exchange of data and assets between different blockchain networks. It enables these networks to communicate and interact with each other effectively, fostering a more connected and collaborative decentralized ecosystem. The objective is to break down the barriers that currently hinder the flow of information and value across disparate blockchains.

The Importance of Interoperability

- Enhanced Scalability: Interoperability mitigates the issue of scalability faced by individual blockchains by allowing them to share the workload. This can lead to increased transaction throughput and improved performance.

- Expanded Use Cases: Different blockchains have been developed with specific use cases in mind. Interoperability enables cross-chain utilization of these use cases, unlocking a plethora of new applications and possibilities.

- Reduced Dependence: Relying on a single blockchain network can pose risks in terms of security and decentralization. Interoperability distributes trust across multiple networks, reducing the dependence on any single entity.

- Global Adoption: A lack of interoperability can create silos within the blockchain space. By connecting various networks, blockchain technology becomes more accessible and usable on a global scale.

Challenges in Achieving Interoperability

While the vision of a connected blockchain ecosystem is promising, achieving full interoperability comes with its own set of challenges:

- Consensus Mechanisms: Different blockchains often employ varied consensus mechanisms, which can hinder agreement on transaction validity and security protocols.

- Smart Contract Standards: Smart contracts on different networks may have unique programming languages and standards, making cross-chain execution complex.

- Security Concerns: Interoperability introduces new attack vectors, requiring robust security measures to safeguard assets during cross-chain transactions.

- Regulatory Compliance: Interoperability may raise regulatory challenges, as transactions spanning multiple networks could involve multiple jurisdictions.

Approaches to Blockchain Interoperability

Several approaches to achieving blockchain interoperability have been proposed, and each comes with its own strengths and limitations:

- Cross-chain bridges: These are connectors between two or more blockchains that facilitate the transfer of assets and data. While effective, bridges might introduce some centralization and security concerns.

- Atomic Swaps: Atomic swaps allow for the direct exchange of assets between different blockchains without the need for intermediaries. However, this method is limited to simple value transfers.

- Sidechains: Sidechains are independent blockchains linked to the main blockchain, enabling two-way asset transfers between them. They can enhance scalability while maintaining a degree of separation.

- Interoperability Protocols: Projects are working on creating protocols that serve as intermediaries, ensuring seamless communication and data exchange between blockchains.

Embracing a Connected Blockchain Ecosystem for Decentralized Applications (DApps)

The rise of decentralized applications (DApps) has showcased the true potential of blockchain technology. These applications eliminate the need for intermediaries, providing users with greater control over their data and transactions. However, the current fragmented state of blockchain networks restricts DApps to operate within isolated environments. Embracing a connected blockchain ecosystem through interoperability is crucial for the widespread adoption and success of DApps.

Fostering a Flourishing DApp Landscape

- Enhanced Functionality: Interoperability opens up a world of possibilities for DApps. They can leverage unique features and data from multiple blockchains, leading to increased functionality and versatility.

- Improved User Experience: A connected blockchain ecosystem offers a seamless user experience for DApp users. Transactions become more fluid, and users can access a broader range of services without leaving their preferred DApp.

- Access to Liquidity: DApps often face liquidity challenges when confined to a single blockchain. Interoperability allows DApps to tap into the liquidity of multiple networks, facilitating better token economics and user engagement.

- Cross-Chain Collaboration: Interoperability encourages collaboration between DApps, fostering innovation, and creating new synergies. Developers can combine their expertise to build more robust and feature-rich applications.

Real-World Applications

- Decentralized Finance (DeFi): Interoperability can revolutionize DeFi by enabling seamless asset transfers between various protocols and platforms. This could lead to more efficient liquidity utilization and enhanced DeFi products.

- Supply Chain Management: Connecting different blockchains in supply chain management allows for end-to-end traceability and transparency. Data from multiple stakeholders can be securely shared, reducing fraud and improving efficiency.

- Gaming Industry: Interoperability allows gaming assets to be tokenized and transferred between games and platforms. Players gain true ownership of their in-game assets, fostering a thriving gaming economy.

Also read: Aether Smart Contracts: Enabling Trustless Transactions

FAQS

Q1: What is blockchain interoperability?

A1: Blockchain interoperability refers to the ability of different blockchain networks to communicate, share data, and exchange value seamlessly with one another. It allows these networks to work together, enhancing overall functionality and opening up new possibilities for decentralized applications.

Q2: Why is blockchain interoperability important?

A2: Blockchain interoperability is crucial because it overcomes the issue of isolated blockchain ecosystems. It enables the transfer of assets and information across various networks, promoting a more connected and efficient decentralized ecosystem. This fosters innovation, increases liquidity, and enhances user experiences.

Q3: How does blockchain interoperability work?

A3: Blockchain interoperability can be achieved through various methods, such as:

- Cross-Chain Bridges: These are protocols that facilitate communication between different blockchains, allowing assets to be locked on one chain and recreated on another.

- Sidechains: These are separate blockchains attached to a main blockchain, allowing assets to move between the main chain and sidechains efficiently.

- Atomic Swaps: This technique enables direct peer-to-peer asset exchanges between different blockchains without the need for intermediaries.

- Middleware Solutions: Some projects act as intermediaries, providing compatibility layers to standardize interactions between different blockchains.

Q4: What are the benefits of blockchain interoperability?

A4: Blockchain interoperability offers several advantages, including:

- Enhanced Scalability: Interoperability allows the load to be distributed across multiple blockchains, improving overall system performance and scalability.

- Expanded Use Cases: It enables the creation of complex decentralized applications that can leverage multiple blockchains’ unique features.

- Increased Liquidity: Interconnected networks lead to more significant liquidity pools, benefiting token holders and traders.

- Improved Accessibility: Interoperability encourages wider adoption as users can access various decentralized services regardless of the underlying blockchain.

Q5: What challenges does blockchain interoperability face?

A5: Despite its potential, blockchain interoperability faces some challenges, including:

- Security Risks: Ensuring secure data and asset transfers between different networks is complex and requires robust protocols.

- Consensus Mechanisms: Coordinating different consensus algorithms and transaction structures can be difficult.

- Standardization: Establishing common standards for interoperability is crucial for smooth communication but can be challenging with diverse blockchain ecosystems.

Q6: What are some projects working on blockchain interoperability?

A6: Several projects are actively developing blockchain interoperability solutions, including:

- Polkadot: It aims to create a heterogeneous multi-chain network, allowing different blockchains to connect and share information.

- Cosmos: A decentralized network of independent blockchains that can communicate through the Inter-Blockchain Communication (IBC) protocol.

- Wanchain: Focused on enabling cross-chain asset transfers and building a distributed financial infrastructure.

- AtomicDEX: A decentralized exchange platform utilizing atomic swaps for cross-chain trading.

Q7: How does blockchain interoperability impact the future of decentralized technologies?

A7: Blockchain interoperability holds the potential to revolutionize decentralized technologies. As different networks seamlessly collaborate, the barriers between various blockchain ecosystems will diminish, leading to a more integrated and efficient decentralized landscape. This fosters innovation and opens up new possibilities for complex applications, ultimately driving the widespread adoption of blockchain technology.