The Emergence of Centralized Finance (CeFi) in the Crypto Market

Table of Contents

In the rapidly evolving landscape of cryptocurrencies and blockchain technology, one trend has emerged as a driving force behind the maturation and mainstream adoption of digital assets – Centralized Finance, or CeFi. As the decentralized ethos of cryptocurrencies initially captivated the imagination of innovators and early adopters, the rise of CeFi introduces a new chapter in the crypto narrative.

This article delves into the remarkable emergence of Centralized Finance within the crypto market, exploring its transformative impact on financial services, market dynamics, and the ongoing interplay between centralized and decentralized paradigms. From the genesis of CeFi platforms to their pivotal role in shaping the future of digital finance, we unravel the forces propelling this paradigm shift and examine the broader implications for both the crypto industry and traditional financial systems.

Unveiling the Evolution: Tracing the Remarkable Rise of Centralized Finance (CeFi) within the Cryptocurrency Landscape

In the ever-evolving world of cryptocurrency, a significant paradigm shift has taken place with the emergence of Centralized Finance (CeFi). CeFi refers to the integration of traditional financial systems and centralized authorities within the decentralized realm of cryptocurrencies. This groundbreaking concept has rapidly gained prominence, reshaping the way we perceive and interact with digital assets.

The journey of CeFi’s rise within the cryptocurrency landscape is nothing short of remarkable. Initially, cryptocurrencies like Bitcoin were conceived to eliminate intermediaries, enabling peer-to-peer transactions without the need for a central authority. This decentralized nature was celebrated for its security and autonomy, as it granted users full control over their funds.

However, as the cryptocurrency market expanded, the limitations of decentralization became apparent. Scalability issues, slow transaction speeds, and lack of regulatory compliance hindered its mass adoption. This is where CeFi steps in, offering a bridge between the established financial world and the innovative potential of cryptocurrencies.

From Decentralization to Dominance: The Intriguing Journey of Centralized Finance (CeFi) in the Crypto Universe

The journey of Centralized Finance (CeFi) from its modest beginnings to its current dominance in the crypto universe is a tale of adaptation, innovation, and collaboration. CeFi platforms emerged as a response to the challenges faced by the decentralized ecosystem. By integrating elements of centralization, such as trusted third-party intermediaries and regulated frameworks, CeFi platforms sought to address the limitations of their decentralized counterparts.

One of the key factors that contributed to CeFi’s intriguing journey to dominance was its ability to provide users with a familiar and user-friendly experience. CeFi platforms offered intuitive interfaces, custody services, and customer support, making them more accessible to mainstream users. This accessibility proved crucial in attracting a broader audience, which had previously been deterred by the complexities of decentralized platforms.

Moreover, CeFi platforms leveraged the existing financial infrastructure, allowing users to seamlessly convert between cryptocurrencies and traditional fiat currencies. This facilitated rapid adoption by enabling users to easily transition between their familiar financial instruments and the world of digital assets.

Breaking Barriers: Exploring How Centralized Finance (CeFi) Revolutionized the Traditional Crypto Market

Centralized Finance (CeFi) has shattered barriers and ushered in a new era of possibilities for the traditional crypto market. Its revolutionary impact can be understood through various lenses:

- Liquidity and Market Efficiency: CeFi platforms introduced high liquidity to the crypto market, enabling users to trade assets with minimal slippage. This enhanced market efficiency and attracted institutional investors who were previously deterred by liquidity concerns.

- Financial Services Ecosystem: CeFi platforms expanded the crypto ecosystem beyond trading, offering a wide range of financial services such as lending, borrowing, staking, and derivatives trading. These services introduced new revenue streams and investment opportunities for users.

- Regulatory Compliance: By integrating regulatory compliance measures, CeFi platforms built trust among regulators and mainstream users. This paved the way for broader acceptance of cryptocurrencies within the legal and financial framework.

- Global Accessibility: CeFi platforms broke down geographical barriers, enabling users from around the world to participate in the crypto market. This inclusivity democratized access to financial services and investment opportunities.

- Innovation and Development: CeFi platforms became hubs for innovation, driving the development of new financial products and technologies. This competitive environment led to rapid advancements in DeFi (Decentralized Finance) and other sectors within the crypto space.

Also read: Aether Smart Contracts: Enabling Trustless Transactions

Centralized Finance (CeFi): A Comprehensive Analysis of its Emergence and Impact on the Cryptocurrency Ecosystem

Centralized Finance (CeFi) refers to the paradigm shift within the cryptocurrency ecosystem where traditional financial models and intermediaries are integrated with decentralized technologies. This comprehensive analysis delves into the emergence and profound impact of CeFi on the realm of cryptocurrencies.

CeFi bridges the gap between the decentralized ethos of blockchain technology and the familiarity of centralized financial services. It leverages the benefits of blockchain, such as immutability and transparency, while offering users the convenience, speed, and accessibility associated with traditional financial platforms. By creating this bridge, CeFi has ushered in a new era of adoption and use cases for cryptocurrencies.

This analysis explores the various aspects of CeFi, including its historical context, key players, technological advancements, regulatory challenges, and implications for the broader financial landscape. It also delves into the advantages and potential drawbacks of CeFi, shedding light on its role in shaping the future of finance.

The CeFi Revolution: A Deep Dive into How Centralized Finance Transformed the Crypto Market Dynamics

The CeFi Revolution represents a pivotal shift in the dynamics of the cryptocurrency market, marked by the integration of centralized financial principles into the decentralized blockchain ecosystem. This deep dive examines the transformative journey of CeFi and its profound influence on the crypto market.

CeFi’s impact on the crypto market is multifaceted. It has democratized access to financial services, enabling users around the world to participate in trading, lending, borrowing, and earning interest on their digital assets. The introduction of CeFi platforms has also enhanced liquidity, reduced price volatility, and provided a familiar entry point for traditional investors to engage with digital assets.

This exploration traces the evolution of CeFi from its early days as a mere extension of the traditional financial sector to its current status as a driving force behind the global adoption of cryptocurrencies. It analyzes the strategic partnerships, innovative product offerings, and user-centric design that have propelled CeFi platforms to the forefront of the industry.

A Critical Examination of Centralized Finance’s (CeFi) Unforeseen Ascendancy in the Digital Financial Realm

This critical examination delves into the unforeseen ascendancy of Centralized Finance (CeFi) within the digital financial realm, dissecting the factors that contributed to its unexpected rise and the implications it holds for the broader financial ecosystem.

CeFi’s ascendancy can be attributed to several factors, including its ability to address key pain points of the traditional financial system, its rapid technological advancements, and its capacity to bridge the gap between decentralized ideals and real-world financial operations. The examination scrutinizes how CeFi’s seamless user experience, integrated services, and regulatory compliance have attracted a diverse user base, including institutional investors and mainstream users.

However, the analysis also raises questions about the potential risks of CeFi’s dominance, such as centralization of power, privacy concerns, and dependency on a handful of platforms. It emphasizes the need for a balanced approach that combines the benefits of CeFi with the principles of decentralization to create a sustainable and inclusive financial future.

Also read: Exploring the Potential of Aether: Decentralized Finance and Beyond

FAQS

Q: What is Centralized Finance (CeFi) in the Crypto Market?

A: Centralized Finance (CeFi) refers to financial services and platforms within the cryptocurrency market that is controlled by centralized entities like exchanges or institutions, where users rely on intermediaries to facilitate transactions and manage their assets.

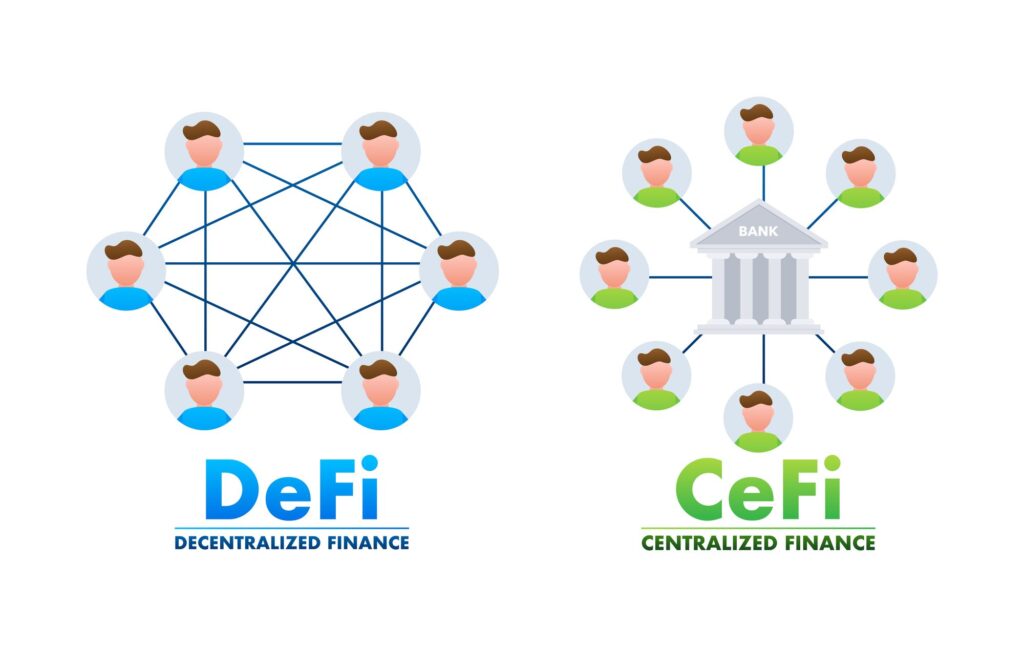

Q: How does CeFi differ from Decentralized Finance (DeFi)?

A: CeFi relies on centralized intermediaries, while DeFi operates on decentralized networks, allowing users to interact directly with smart contracts and protocols without intermediaries.

Q: What are some examples of CeFi platforms?

A: Examples of CeFi platforms include Coinbase, Binance, and Kraken, where users can trade, lend, borrow, and earn interest on their cryptocurrencies through a centralized interface.

Q: What are the advantages of using CeFi platforms?

A: CeFi platforms often provide a user-friendly experience, high liquidity, and customer support, making it easier for newcomers to enter the crypto market and execute trades.

Q: What are the concerns associated with CeFi?

A: CeFi platforms can be vulnerable to hacking attacks, as they store users’ funds and personal information centrally. Additionally, they may require users to trust the platform’s security measures and policies.

Q: How has CeFi contributed to the growth of the crypto market?

A: CeFi has played a crucial role in increasing the adoption of cryptocurrencies by offering a familiar and accessible way for individuals to buy, sell, and manage their digital assets.

Q: What regulatory challenges does CeFi face?

A: CeFi platforms often operate in a legal gray area, facing regulatory scrutiny from various jurisdictions due to concerns related to money laundering, fraud, and investor protection.

Q: Can CeFi and DeFi coexist?

A: Yes, CeFi and DeFi can coexist, offering users different options based on their preferences and risk tolerance. Some users may prefer the convenience and security features of CeFi, while others might opt for the autonomy and transparency of DeFi.

Q: How might CeFi evolve in the future?

A: CeFi platforms could evolve by incorporating more decentralized features, enhancing security measures, and adapting to changing regulatory landscapes to provide a more robust and trusted financial ecosystem within the crypto market.